HE is wanted for allegedly ruthlessly exploiting Bangladeshi workers in Malaysia and for money activities.

HIS profile as a wanted person, has no doubt increased the public's interest in READ : the Government's recent contract award to Bestinet, that could spiral above the RM3 3 billion mark.

VERY little has been done to look into the affairs of others who have benefited from being associated with Aminul Islam Abdul Nor.

WHY should they be investigated? Well because just like Aminul Islam Abdul Nor, they too are in the crimes against humanity dock for exploiting foreign labour.

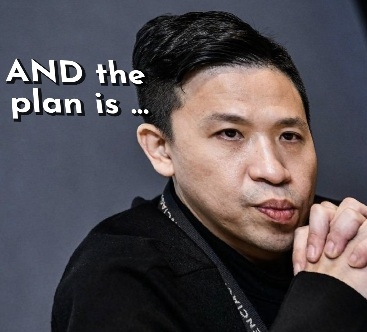

CHIEF among them is the public listed company controlled by Aminul Islam Abdul Nor's alter ego/ business partner, Victor Chin Boon Long's MMAG Bhd.

AN investigation on Aminul Islam Abdul Nor and MMAG's conduct with regards to foreign labour in the East Coast Railway Link during the Covid years, is the key to opening a can of worms.

AMINUL Islam Abdul Nor, himself had very big plans, alongside Victor Chin Boon Long for MMAG Bhd managing foreign workers in Malaysia.

TO think that while all these bad press and international pariah status given to them by Bangladesh, this same group of people are now consolidating their position in another, public listed company (Datasonic Bhd) involved with KDN related contracts is just plain TOXIC.