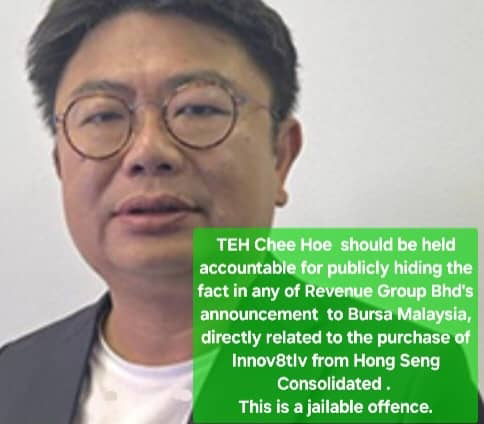

IT seems a raw nerve has been hit, exposing an achilles' heel in the form of Revenue Group Bhd's executive director cum substantial owner, Teh Chee Hoe.

TEH Chee Hoe by right should be charged for fraud and when found guilty be jailed for deliberately not informing Revenue Group minority shareholders in any of the documents submitted to Bursa Malaysia pertaining to the purchase of Innov8tiv from Hong Seng Consolidated, that the shares he claimed as his own were actually registered to Hong Seng Capital.

DO note at the time when Teh Chee Hoe was publicly using the mainstream media to meet his personal agenda, the executive director of Revenue Group owed millions of Ringgit, to a money lending company owned by Hong Seng.

REVENUE Group went out of its was way to ensure minority shareholders didn't get to vote on the deal by stating the following;

THE highest percentage ratio for the Proposed Acquisition pursuant to Paragraph 10.02(g) of the Main Market Listing Requirements, is 22.92%, being the Purchase Consideration over the

latest audited consolidated net assetsof REVENUE as at 30 June 2022. As such, the Proposed Acquisition does not require the approval of shareholders of REVENUE.

CONTRAST this to Revenue Group's sudden interest in getting minority shareholders to vote on a proposal to sell Innov8tiv to Datasonic Group Bhd. READ ; Revenue Group suddenly has minority shareholders interest in sight?

BY having minorities vote, it seems Revenue Group is looking to use thecvote as an endorsement in retrospect in favour of Teh Chee Hoe.

BURSA Malaysia, if it had any dignity left, should file criminal charges on Teh Chee Hoe.