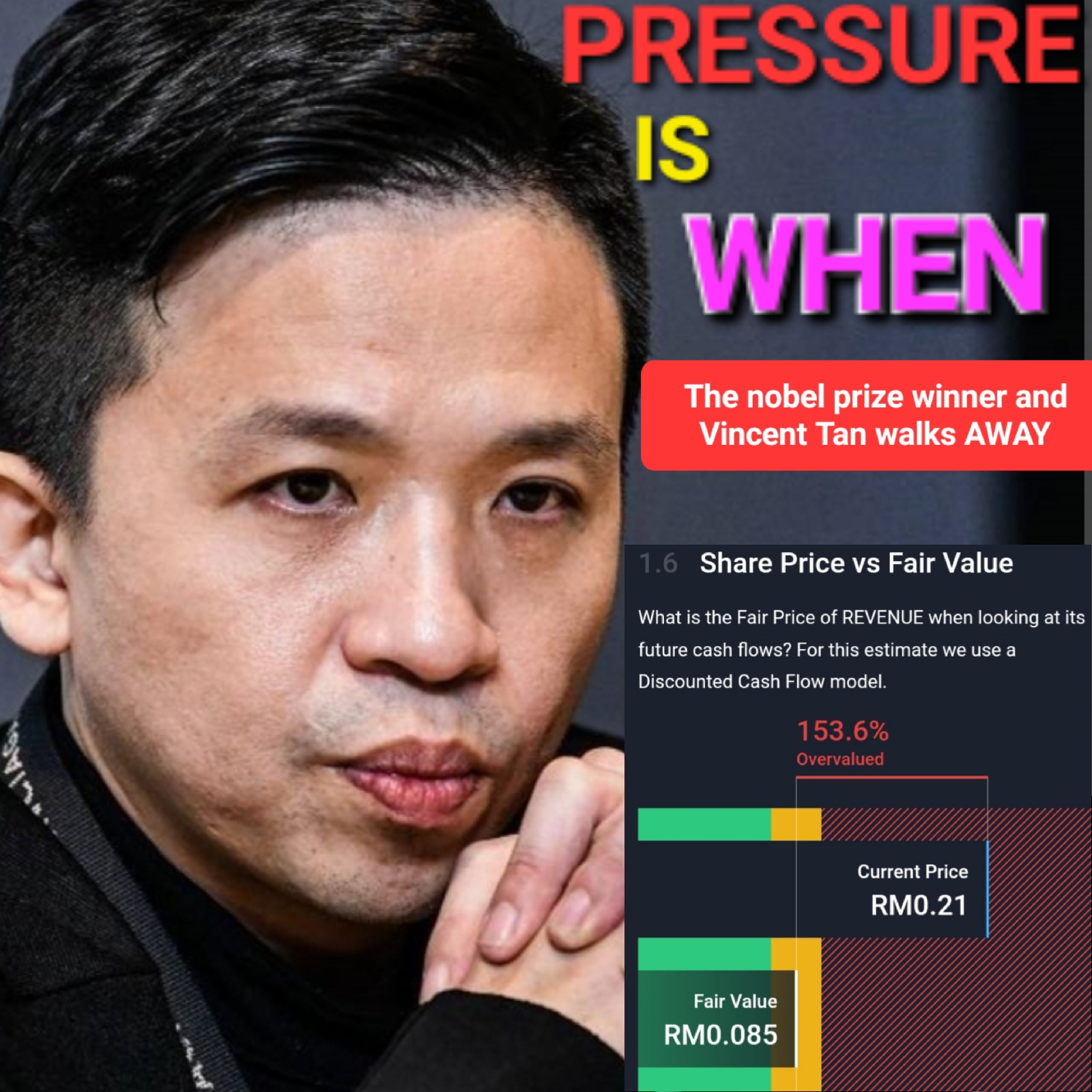

REVENUE Group at 21.5 sen is over valued by READ : some 153 per cent to bring its fairvalue at 8.5 sen a share.

A steep market value over Its fair value , how ever was not a convincing story for READ : the 2022, Nobel prize winner in. economics, Douglas W Diamond who helps run the DFA Fund, nor Malaysian billionaire Vincent Tan who owns Interpac to remain as shareholders of Revenue Group.

THE American fund and the billionaire, it seems had run away far from Francis Leong Seg Wui as perhaps they do not want to be cursed with guilt via association.

ARE they other reasons why the big money is screaming to the small money to get the hell out while they still can.

SO what is the reason? It's a four letter word known as Levered Free CashFlow. Revenue Group's Levered Free Cashflow is not only negative, it is negatively deep in red to the tune of RM 44 million.

WHAT is Levered free cashflow? Levered free cash flow (LFCF) is the amount of money a company has left remaining after paying all of its financial obligations. LFCF is the amount of cash a company has after paying debts,