AH Long's for the sake of this article refers solely and specifically to licensed money lenders, that comes under the control of the Ministry of Housing and Local Government.

GOING by what is being practised at Hong Seng Consolidated's money lending division, I believe Malaysians must apologies for stigmatising money lenders. READ : In 2023, Bernama Reported that licensed money lenders are acting like thugs.

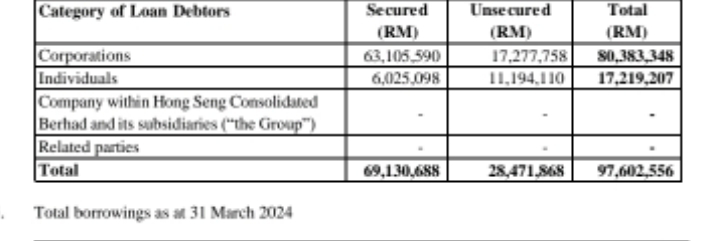

JUST look at the good deeds of Hong Seng Consolidated's money lending arm VIEW : lent out RM97 million of which 29 per cent or some RM28 million were given out without any collateral.

ON top of that, two of the organisations given by the money lender a collective credit limit of RM108 million, only provided securities as collateral amounting to just under RM52 million.

THE text book tells us READ ; Lenders typically offer less than the value of your pledged asset, and some assets might be heavily discounted. For example, a lender might only recognize 50% of your investment portfolio for a collateral loan.

CURRENTLY more than five per cent of the RM92 million lend out is in default which works out to more than RM5 million.

BUT I reckon what ever the text book has teached us is wrong. The Bernama article too must be flawed.

EVERYTHING now seems to be crystal clear, on why another public listed company in which Leong Seng Wui is executive director saw strange cash, defying the laws of economics flow in.

AND when Leong Seng Wui, was the Green Packet Bhd Executive Director, read the article above ; the same shit happened.