AWANG Adek is a former Malaysian Ambassador to the USA, a former deputy Finance Minister, who for a short while , was seen as the next Anwar Ibrahim in UMNO, while Wahid Omar was a former top banker, but Hong Seng Consolidated and Revenue Group are treating the duo like Krusty The Clown.

KRUSTY the Clown is a recurring character on the animated television series The Simpsons, which by the looks of it, has a better standing than the chairman of the Securities Commission and the chairman of Bursa Malaysia.

NO folks, I am not being mean, nor do I wish to be kind, especially when you consider the following. READ : Revenue Group says Innov8tif is a subsidiary company and that it contributed RM1.75 to the Group's turnover.

IF you recall both Hong Seng and Revenue Group had both made statements to the stock exchange on intentions to trade on Innov8tif amongst themselves, yet until yesterday, there were no statement to the exchange that the deal had been completed.

WHY is this so ? Why are minority shareholders being short changed in this manner.Both Bursa Malaysia and Securities Commission should put their foot down on this matter.

TALKING about being short changed, how about this one. Revenue Group under Francis Leong Seng Wui for the 12 months just ended , lost RM3.50 for every RM1 of cash the company had spend.

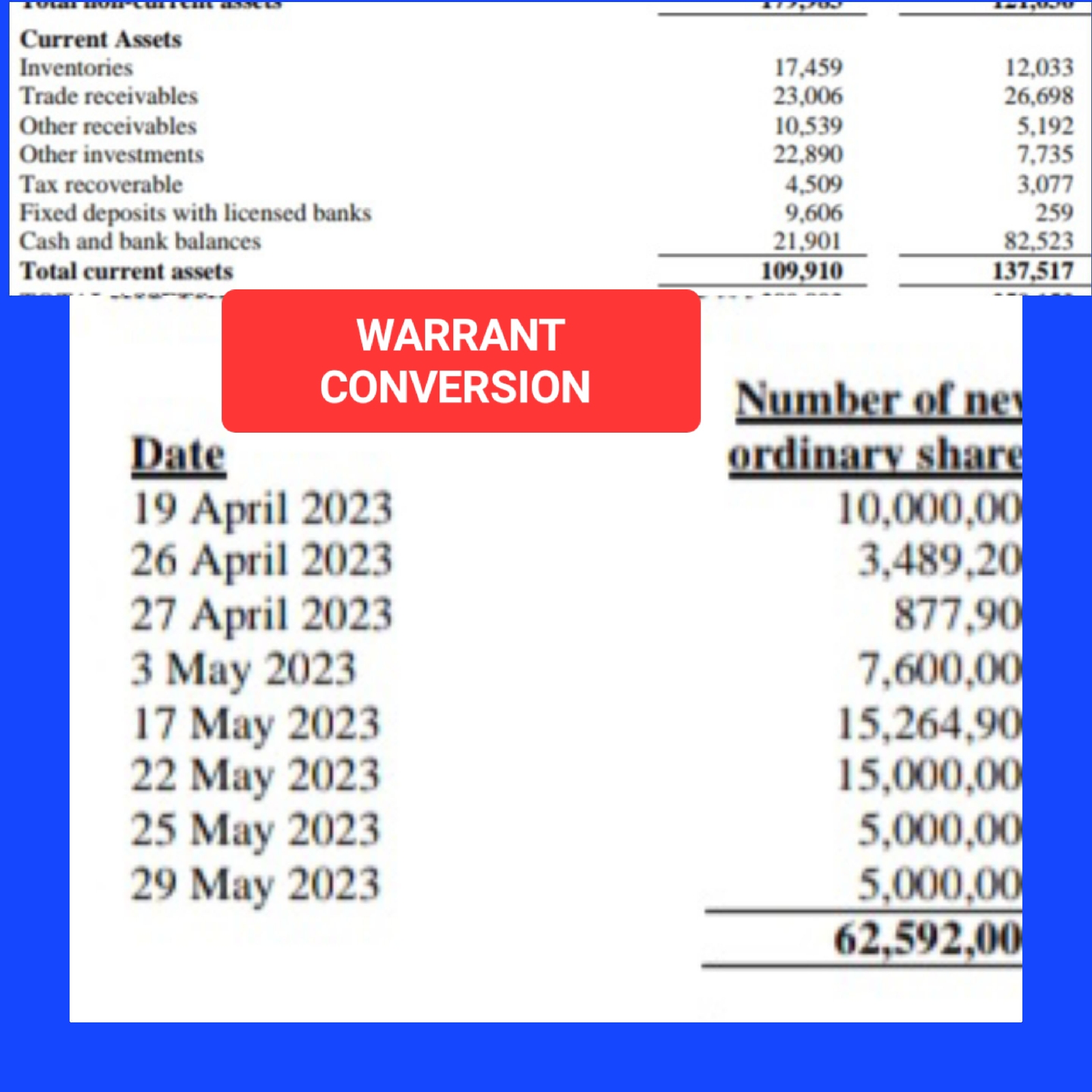

AT the start of financial year, REVENUE Group had RM82.52 million cash and if you add the RM62.59 million the company received by a warrant conversion thar makes no economic sense, its total cash should come up to RM145.11.

UNFORTUNATELY, Revenue Group is now only left with RM21 million, but it has a borrowing of about RM40 million, which basically means theoretically the company has a negative bank balance.

And also for the final quarter, for every RM 1 in turnover brought into the company,Revenue was losing about 55 sen.

HONG Seng Group is no better. Eventhouh on paper it still has RM37.59 million cash, it still hasn't paid Innov8tif Consortium Sdn. Bhd some RM24.41 million, which means it's real cash position is merely RM13.8 million from RM74.18 million before.

BANK borrowings meanwhile stood at RM11.36 million.

SIMILAR to Revenue Group all the the cash has been taken out of the company. Combined from their peak valuation within the past 24 months, their market capitalisation have lost close to a stunning RM7 billion