THE Environmental, Social and Governance Platform or best known by its acronym ESG, have often been touted by its critics as a work in progress conceptional plan.

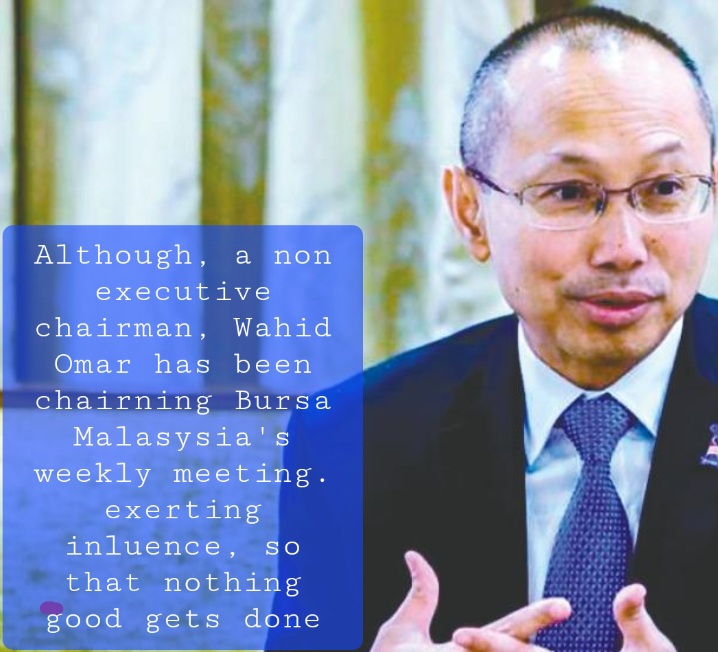

THEN of course we have people like Wahid Omar, who although on paper is designated as non executive, his weekly chairing and input on Bursa Malaysia's weekly meetings, has seen him impose his will on the working committees.

WAHID can certainly READ : can certainly talk a good ESG talk, but in terms of practising it, there is nothing much to say, from Serba Dinamik Bhd to Revenue Group Bhd, its the same sad story.

IN the case of Hong Seng Consolidated , the report first prepared on October 2021 by VIEW : Morningstar Sustainalytics, is condemning and worrisome enough.

YET, it is short and very presice. If Bursa Malaysia, truly wants ESG to be followed by the retail market, then every public listed company should have this on pager report, which is good enough for investors to have an informed overview of a company.

MY take back from the report above, just by glancing at it one time, is that, Hong Seng Consolidated which through out very late 2020 and most of 2021, announced one giant plan after another, running into billions of Ringgit, was basically a company with a staff strength of TWENTY TWO.

THAT in it self should have been a red flag, that perhaps the projects were the pie in the sky type.

AT, Hong Seng Consolidated 's peak market valuation of RM8 billion, its staff strength to market valuation (8 billion/22) was an astonishing RM363 million per staff.

YET for a company, with a RM363 million per staff as its headline, the report notes that based on the ESG score card 32.6, Hong Seng Consolidated is the type of company that is negatively impacting the environment and has employees who are being poorly treated.